How to Lose Money in the Stock Market

Feb 23, 2022Is there a special investment formula, some secret sauce to "beat" the market? Do others know something you don't know? Is there a great stock that you should buy straightaway? Is now the time to "set it out" and wait for the correction to be over?

No, no, no, and no.

Probably not the answers you were hoping for.

Well, maybe the best thing to do is wait for the inflation numbers to improve, or see how the Federal Reserve decides to implement interest rate changes. Maybe the Russian invasion of Ukraine will de-escalate, or maybe after the midterm elections, the market will be more calculable.

Or, maybe not.

The uncertain feeling of what direction the investing winds will blow is completely natural, and if it's any consolation, not knowing puts you in good company. Consider what the great investor and father of index investing had to say about market timing.

“The idea that a bell rings to signal when to get into or out of the stock market is simply not credible. After nearly fifty years in this business, I don’t know anybody who has done it successfully and consistently. I don’t even know anybody who knows anybody who has.”

Jack Bogle - Vanguard Group Founder

It is quite possible that learning how people lose money in the market is far more beneficial than the search to discover a proven system for picking winning stocks. The evidence below suggests that reacting to market swings has proved to be a loser's game.

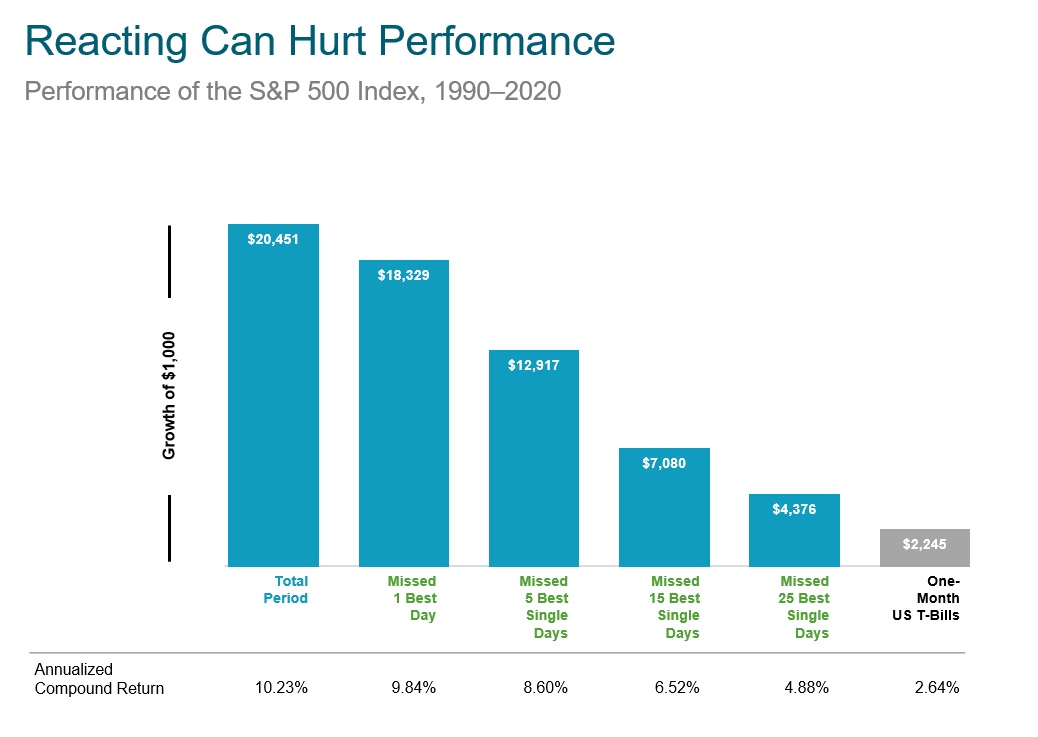

A $1000 that remained invested in the S&P 500 Index over the 30 year period from 1990-2020 received an annual compound return of 10.23%, resulting in an ending balance of $20,451.

Playing the guessing game, and missing only a few days of strong returns had a drastic impact on overall performance, and missing just 25 of the best days in the market over those 30 years reduced the annualized compound return down to 4.88%, leaving the ending balance at just $4,376.

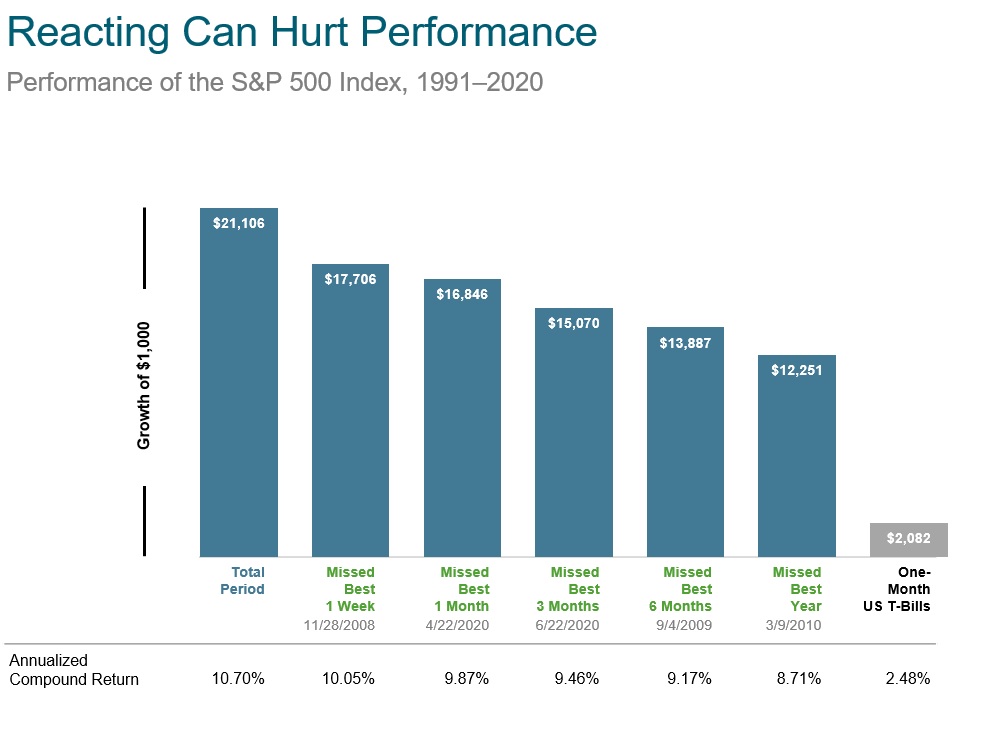

Missing consecutive days of strong returns from setting out of the market for a few weeks, months, or even missing a strong year can also have a significant influence on investment returns.

Each and every day there is a new stock market idea that was dreamed up the day before. There will always be a tragedy du jor and there will always be a financial news guru instilling the fear of missing out into anxious watchers. Some short-term investment ideas will work, and with luck, some gambling may actually pay off, but no one knows for sure how or when to place that bet.

The alternative is knowing how losses happen and then taking the necessary steps to ensure the opposite.

Focus on what you can control.

- Create an investment plan to fit your needs and risk tolerance.

- Structure a portfolio along the dimensions of expected returns.

- Diversify globally.

- Manage expenses, turnover, and taxes.

- Stay disciplined through market dips and swings.

Finally, learning to hold on to an investment may not be as exciting as day trading cryptocurrency or contemplating the great stock tip you got from your neighbor. You won't be sitting on the edge of your seat wondering what is going to happen to the IPO you took a chance on buying.

The satisfaction from a strategy like long-term index investing is more akin to finally sitting in the shade of a tree that you planted as a sapling years ago.

Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio. Past performance is not a guarantee of future results.

In US dollars. For illustrative purposes. The missed best day(s) examples assume that the hypothetical portfolio fully divested its holdings at the end of the day before the missed best day(s), held cash for the missed best day(s),

and reinvested the entire portfolio in the S&P 500 at the end of the missed best day(s). Annualized returns for the missed best day(s) were calculated by substituting actual returns for the missed best day(s) with zero.

S&P data © 2021 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. “One-Month US T- Bills” is the IA SBBI US 30 Day TBill TR USD, provided by Ibbotson Associates via Morningstar Direct. Data is

calculated off rounded daily index values.

Stay connected with news and updates!

Join our mailing list to receive the latest news and updates from our team.

Don't worry, your information will not be shared.

We hate SPAM. We will never sell your information, for any reason.